Black Tube Sex Hub

Exploring the world of adult entertainment and erotic content.

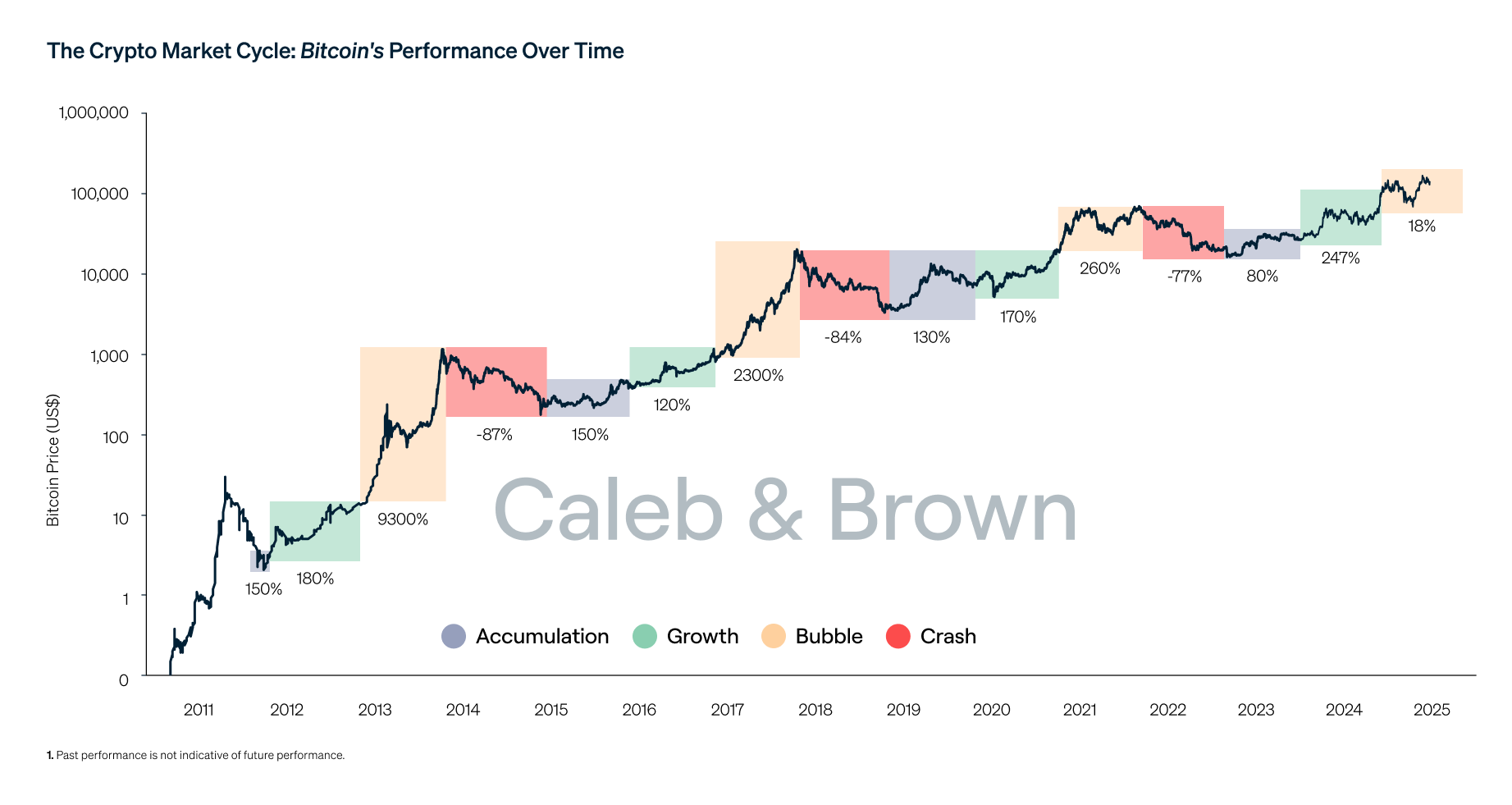

Crypto Chaos: How Market Volatility Shapes Your Digital Fortune

Unravel the wild world of crypto! Discover how market volatility can make or break your digital fortune in this essential guide.

Understanding the Ripple Effect: How Global Events Drive Cryptocurrency Volatility

The cryptocurrency market is notoriously volatile, and one of the key factors contributing to this instability is the ripple effect of global events. From geopolitical tensions to economic downturns, significant occurrences around the world can lead to swift and sometimes unpredictable changes in cryptocurrency prices. For instance, when a country announces regulatory changes regarding digital currencies, it can trigger a wave of panic or optimism among investors, leading to dramatic price fluctuations. This phenomenon is not just limited to negative news; positive developments, such as the adoption of blockchain technology by major corporations, can also create a ripple effect that drives prices higher as investors rush to capitalize on perceived opportunities.

Understanding this ripple effect requires a closer look at the interconnectedness of global markets and how news travels in the digital age. News outlets, social media platforms, and cryptocurrency exchanges all contribute to a rapid dissemination of information that can influence trading behavior. For example, a sudden political unrest in one region can lead to a surge in cryptocurrency investments as individuals seek safer assets outside traditional markets. Investors should remain vigilant and stay informed about global developments, as understanding the broader implications of these events can provide invaluable insight into potential price movements in the cryptocurrency space. Volatility is a hallmark of the crypto market, but by recognizing the ripple effect, investors can better navigate the tumultuous waters of digital currency trading.

Counter-Strike is a highly popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players can choose to play as either side and engage in tactical gameplay that requires teamwork and strategy. For those looking to enhance their gaming experience, using a cloudbet promo code can provide exciting opportunities and bonuses.

Investing in Uncertainty: Strategies to Navigate the Wild World of Crypto Markets

Investing in the crypto markets can feel like stepping into a wild world of uncertainty, with prices swinging wildly and new projects emerging daily. To navigate this volatility, diversification is key. Rather than putting all your funds into a single cryptocurrency, consider spreading your investments across a range of digital assets. This not only mitigates risk but also increases your chances of capitalizing on emerging trends. Additionally, research is paramount; staying informed about market developments, regulatory changes, and technological advancements can provide a deeper understanding of where your investments may lead.

Another effective strategy for managing uncertainty is to adopt a long-term perspective. While it’s tempting to react to short-term fluctuations, focusing on the potential future value of cryptocurrencies can help investors stay grounded. Implementing a dollar-cost averaging approach can also be beneficial; this involves consistently investing a fixed amount over time, which can reduce the impact of market volatility. Lastly, having an exit strategy in place, including stop-loss orders, allows investors to protect their capital and make informed decisions amidst the chaos of the crypto realm.

What Makes Cryptocurrencies So Volatile and How Can You Protect Your Investments?

The volatility of cryptocurrencies can be attributed to several factors. First, the market is relatively young and still in its growth phase, leading to substantial fluctuations in price as it responds to news, regulatory changes, and investor sentiment. Moreover, the decentralized nature of cryptocurrencies means they are subject to speculation and trading by a smaller pool of investors compared to traditional assets. For instance, a single tweet from an influential figure can dramatically shift the market, causing prices to skyrocket or plummet within hours. Additionally, the scarcity of some cryptocurrencies, driven by fixed supply models like Bitcoin's 21 million cap, creates substantial price volatility as demand fluctuates.

To protect your investments in such a volatile environment, consider implementing strategies that can help mitigate risk. Here are a few effective approaches:

- Diversification: Spread your investments across different cryptocurrencies and asset classes to reduce the impact of a poor-performing asset.

- Research: Stay informed about market trends, news, and technological developments in the crypto space to make educated decisions.

- Set Limits: Use stop-loss orders to minimize potential losses and establish exit strategies ahead of time.

- Invest Wisely: Only invest money you can afford to lose and avoid making impulsive decisions based on market hype.